The Global Energy Investment Challenge

Christian Rynning-Tønnesen outlines why global clean energy investment must scale faster, and how systemic reforms, stable policy, and coordinated action are critical to reaching net zero by 2050.

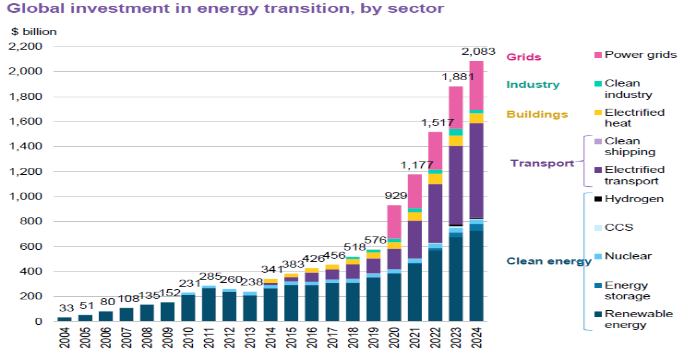

Global energy investment reached USD 3.3 trillion in 2025, with USD 2.2 trillion directed toward clean energy, according to IEA. The largest sub-categories within the clean energy investments are renewable energy (USD 780 billion), energy efficiency (USD 773 billion), and grids and storage (USD 479 billion). When the Paris Agreement was signed in 2015, clean energy and fossil fuel investment stood at parity. Today, that ratio has reached 2:1, and for power generation specifically, renewable and nuclear investment now exceeds fossil fuel investment by a factor of 10:1.

Despite this progress, BNEF estimates that global energy transition investment would need to average USD 5.6 trillion each year from 2025 to 2030, in order to get on track for global net zero by 2050, in line with the Paris Agreement. This estimate implies that current investment levels are below 50% of what is required to get on track.

As technology costs have declined substantially the barriers to achieving USD 5.6 trillion in annual clean energy investments are now primarily systemic rather than technological. Scaling investments to the level needed requires several actions.

First, financing costs could be reduced by establishing stable policy frameworks. Stable revenue will mobilize low-cost financing and a good way is to secure long-term contracts at fixed prices, either through Government-backed regimes or large corporate offtakes. As an example of the latter, data centers are emerging as the largest single source of new renewable power contracts (PPAs) in Europe, already accounting for a third of the market, according to Pexapark.

Second, Governments must streamline the often lengthy permitting processes and strengthen the local grid infrastructure and supply chains to accelerate project execution. Lagging investments in the power grid is a common issue in most countries, creating curtailment and integration challenges, indicated by the fact that grid spending has grown at less than half the pace of generation investment.

Third, on a global level, critical mineral refining and clean technology manufacturing must be diversified away from concentrated geographies. The recent examples of announced battery manufacturing in advanced economies that have not materialized show how difficult this diversification really is.

Addressing these challenges demands coordinated action across governments, multilateral institutions, and private capital to de-risk investments, support project execution and mobilize the capital required for energy transition at the necessary scale and speed.

About Christian Rynning-Tønnesen

Christian Rynning-Tønnesen is one of the most experienced and influential leaders in the Nordic and European energy and industrial sectors, with a career spanning electricity, hydrocarbons, process industry and capital-intensive infrastructure internationally. He is known for combining market expertise, industrial scale and long-term strategic vision at a time of profound change in the global energy system.

In Statkraft, Christian Rynning-Tønnesen headed corporate strategy for more than a decade combined with various EVP positions including deputy CEO and served as CEO from 2010 to 2024. During his tenure, Statkraft went through one of the most extraordinary transformations in the renewable energy sector - evolving from a Norwegian hydropower producer into Europe’s largest producer of renewable energy and a leading player in global energy markets.

Prior to Statkraft, he has experience from natural gas liquefaction at SINTEF, oil refining in Exxon and advising several companies as an energy expert in McKinsey. Before he was appointed CEO in Statkraft, Rynning-Tønnesen was CFO and subsequently CEO of Norske Skog, which at the time was one of the world’s largest producers of publication paper with operations in Europe, Asia, Australia, New Zealand and Canada. He led a massive turnaround of the company in a period of heavy global market pressure within the paper industry.

He is currently a Senior Executive at Aker, one of the largest industrial groups in Norway, with senior responsibilities within renewable energy and large AI datacentres. He also holds board positions in shipping- and communication technology- companies.

Christian Rynning-Tønnesen is Origination’s Knowledge Partner and Chair of the Origination’s Energy Transition sector.